Share

Community banks & fintechs: lessons from the past decade

Alloy was built on the vision of creating a more dynamic and accessible financial industry, by helping financial companies deploy safe and seamless digital customer experiences. Core to achieving our vision is strengthening the infrastructure of America’s community banks, who represent 97% of US banks.

In our Community Banking series we explore the past, present, and future of community banking, and how fintechs are collaborating with community banks to improve how individuals, small businesses and communities nationwide access financial services.

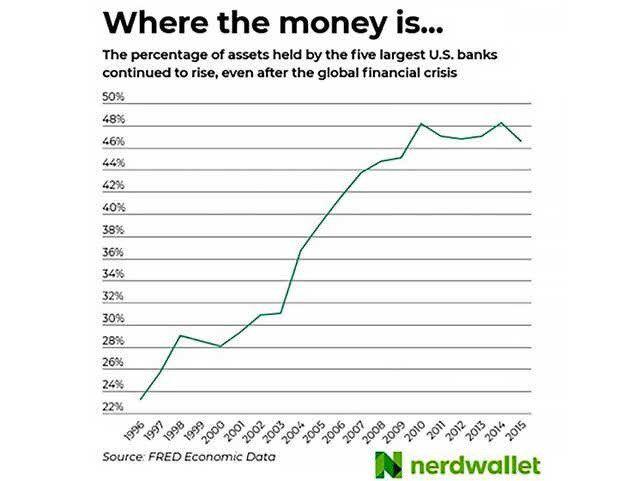

Big banks dominate deposits

For decades, community banks have been losing deposit share to the nation’s largest financial institutions, and the problem is only getting worse. From 2013 to 2017, total deposits at banks with assets of less than $1 billion fell by 7.5%. Over the same period, total deposits at banks with assets of more than $1 billion grew by trillions.

By 2019, over 40% of total assets were held by the four largest banks alone — JPMorgan Chase, Bank of America, Citibank, and Wells Fargo.

2012–2016: Banks vs. fintechs

The slide in community bank deposits reflects several factors. In the last decade, banks faced competition from a record-breaking bull market; interest rates that hovered at or near historically low levels; tepid real (versus nominal) wage growth despite a low unemployment rate; and businesses that drew down cash supplies for investment during a strong economy.

Yet beyond the recent financial climate, there is one factor that represents a fundamental and persistent challenge to community banks’ deposit growth — consumers’ demand for tech-enabled convenience.

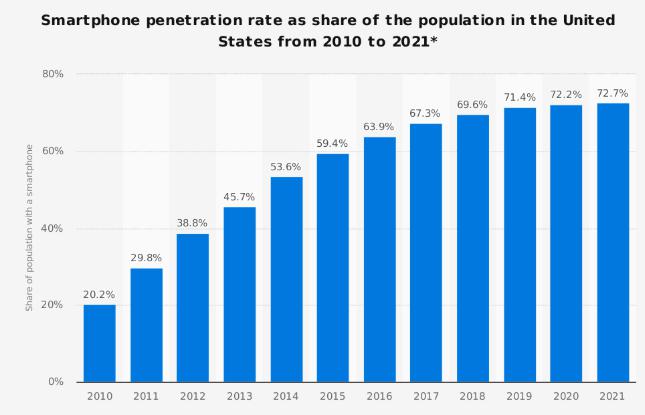

The last decade saw the rise of the smartphone. In 2010, an estimated 20% of Americans tucked a portable computer in their pocket. By 2019, that number had rocketed past 71%. Increasingly, it became clear that Americans want and expect to conduct more and more business, including banking, online and on their phones.

As the 2010’s opened, new financial technology companies rushed to meet consumers’ digital demands, further jolting a banking industry still recovering from the 2008–2009 Great Recession. Quickly, it became banks vs. fintechs.

The biggest banks outran the new tech companies by investing billions in developing or acquiring their own technology. Community banks, on the other hand, were unable to match these huge spends. Without tech, some small banks were fatally squeezed between the new entrant fintechs on one side and their larger peers on the other.

2016–2019: Banks + fintechs

As the 2010’s unfolded, however, this confrontational approach reversed, at least for small banks. It became increasingly clear that neither fintechs nor community banks could thrive alone.

Community banks need technology to meet customers’ appetite for digital convenience. Lacking the resources and expertise to build products in-house, small banks must partner with fintechs to survive. As the Boston Consulting Group wrote in 2019, “For the things they cannot do well on their own, banks must develop a partnership strategy.”

But such partnerships, however critical, do not equate to small banks being at the mercy of tech companies. Far from it. Banks hold something essential to fintechs — charters. Fintechs need to partner with banks who hold the charters, FDIC protection, and customer relationships required to deliver financial services.

Already, the industry has seen fintechs and banks partner to offer new services. Fintech Petal Card partners with WebBank to offer a re-imagined starter credit card. Fintech Aspiration teamed up with Coastal Community Bank to offer checking accounts with a conscience by donating 10 cents of every $1 in revenue to charity. Fintech Brex partnered with Radius Bank (acquired by another fintech, LendingClub, early 2020) to offer a simple business bank account for small and start-up businesses.

Beyond their complementary needs, there is much common ground for small banks and fintechs. Both compete with big banks. Both are resource-efficient. Both excel at personalized services, especially for underserved or unserved parts of the population. Both value customer relationships in a way that big banks can’t, won’t, or simply aren’t incentivized to do.

2020: COVID-19 crisis & opportunity

At the start of the new decade it was clear that banks and fintechs were learning how to thrive together through collaboration, and increasingly, acquisitions. Until an unexpected crisis landed — the global COVID-19 pandemic.

While coronavirus had begun sweeping the globe in February, it took until early March 2020 to hit the shores, and economy of the US. The long-term effects of the COVID-19 crisis on the banking industry and the economy at large are still not wholly known. But we’re already experiencing social distancing measures bringing new, acute urgency to community banks’ digitization efforts and a boost to fintech app adoption.

An estimated 75 million Americans have made the transition to working, and banking, from home. Long-time branch-only customers have suddenly opened digital banking accounts for the first time, causing an echo boom of digital phishing scams and fraud attempts. As the crisis unfolds, we may well see the gap widen between banks who have invested in a secure and strong digital customer experience and those who have not.

In addition, as the US federal government responded to the economic fallout with the largest stimulus package in its history, banks were forced into figuring out how to disburse trillions of dollars in SBA loans digitally, while maintaining fraud prevention measures.

In many ways, the rapid change wrought by COVID-19, is accelerating trends long in the making. The pandemic offers even more incentive for community banks and fintechs to collaborate. Together they can bolster digital banking services and serve on “the front lines” to ensure small businesses emerge intact on the other side of social distancing measures.

COVID-19 is a health and economic disaster, but it may also prove a transformative opportunity for community banks and fintechs alike.